Analyze, optimize and improve

Take data driven decisions. Stop guessing.

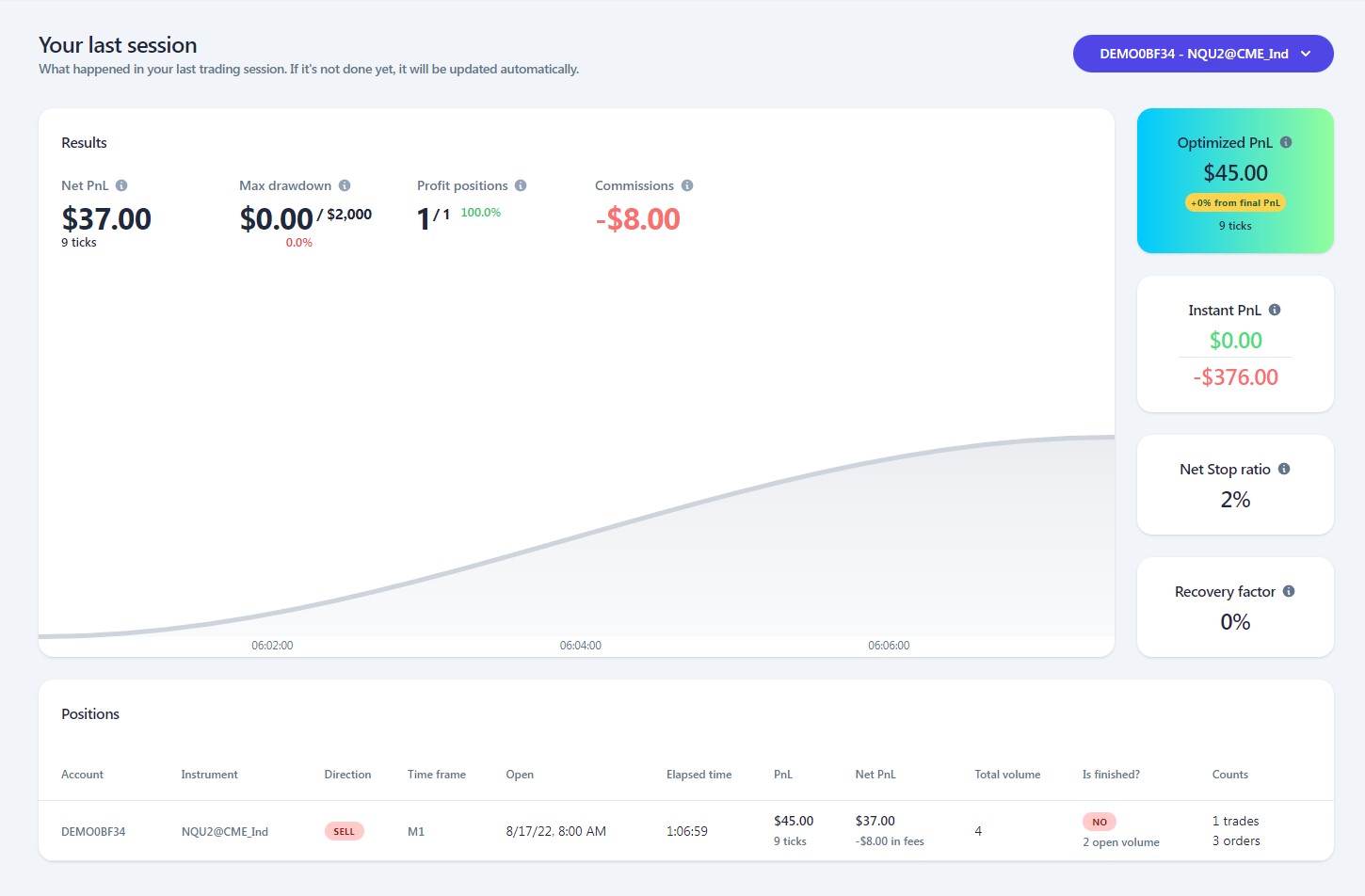

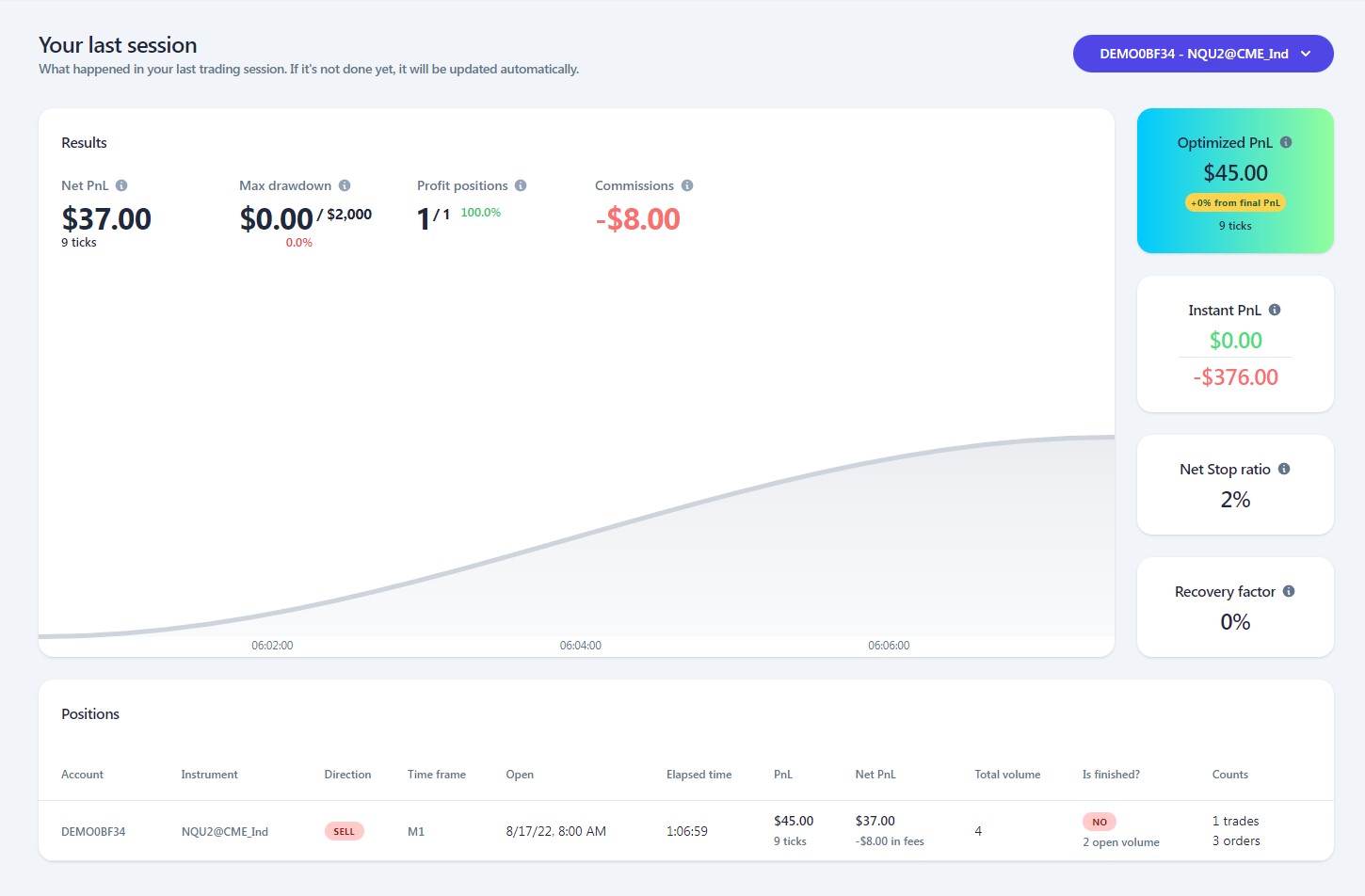

A lot of possibilities are unleashed once all your trading history is recorded. You will be able to analyse your trading sessions in detail, review metrics by different time frames, see what is working and not, and then take data driven decisions to improve your confidence while you trade.

Trading analysis

Using the Trading session indicator it will be recording all your trading history and send it back to the analysis system to perform a professional analysis to improve your trading. Taking data driven decisions will improve your confidence. You will relax by thinking in the long term.

The system will generate metrics based on your daily trading activity, and we'll provide a set of charts and filters, so you will be informed on what is working and what is not over time.

Metrics

All metrics are tracked by instrument, broker account (including DEMO accounts), and the day that was generated.

For each metric we store the Total, TotalMax, TotalMin, Max, Min and Average. For all positions, and we also store the same values for long and short positions independently. TotalMax and TotalMin store the max/min values of the accumulative value. Max and Min store the max/min values individually.

Results

| Metric name | Details | Formula |

|---|---|---|

| Ticks | Num ticks (will include max and min for ongoing fluctuations of the price). For that we will need to use closed partial ticks. | `Position`.`PnLTicks` |

| OptimizedTicks | Entering at the best moment and quitting at the best moment. | `Position`.`PnLTicks` + `Position`.`MaxAgainstTicksDuringPosition` + `Position`.`MaxFavorTicksAfterClosePosition` |

| PnL | Profit and Loss. | `Position`.`PnL` |

| OptimizedPnL | Entering at the best moment and quitting at the best moment. | `OptimizedTicks` * `Instrument`.`TickCost` |

| NetPnL | PnL minus commissions. | `Position`.`NetPnL` |

| ProfitFactor [GLOBAL] | Profit Factor is the system's Gross Profit divided by Gross Loss. If your strategy has only winning trades and no losing trades, then Profit Factor is Infinity. | `Metric`.`ProfitPnL`.`Total` / ABS(`Metric`.`LossPnL`.`Total`) |

| ProfitPnL | Sum of PnL for profitable positions. | `Position`.`ClosedPartials[x].TotalTicks` > 0 ? `Position`.`ClosedPartials[x].TotalTicks` * `instrument`.`TickCost` : 0 |

| ProfitTicks | Sum of ticks for profitable positions. | `Position`.`ClosedPartials[x].TotalTicks` > 0 ? `Position`.`ClosedPartials[x].TotalTicks` : 0 |

| LossPnL | Sum of PnL for loss positions. | `Position`.`ClosedPartials[x].TotalTicks` < 0 ? `Position`.`ClosedPartials[x].TotalTicks` * `instrument`.`TickCost` : 0 |

| LossTicks | Sum of ticks for loss positions. | `Position`.`ClosedPartials[x].TotalTicks` < 0 ? `Position`.`ClosedPartials[x].TotalTicks` : 0 |

| Commission | Total commission for a given position. | `Position`.`TotalCommission` |

Execution

| Metric name | Details | Formula |

|---|---|---|

| Volume | Num contracts executed (open volume) | `Position`.`TotalVolume` |

| Trades | Num trades executed. | `Position`.`TotalTrades` |

| Positions | Num open positions. | `Positions` |

| ProfitPositions | Count of positions with positive net PnL. | `Position`.`NetPnL` > 0 ? 1 : 0 |

| ProfitTrades | Count of positions with positive profit ticks. | `Position`.`ClosedPartials[x].TotalTicks` > 0 ? 1 : 0 |

| LossPositions | Count of positions with negative net PnL. | `Position`.`NetPnL` < 0 ? 1 : 0 |

| LossTrades | Count of positions with negative profit ticks. | `Position`.`ClosedPartials[x].TotalTicks` < 0 ? 1 : 0 |

Drawdown

| Metric name | Details | Formula |

|---|---|---|

| Drawdown | Distance between profit and loss in different scenarios. | `Metric`.`PnL`.`TotalMin` |

| RelativeDrawdown | Maximum Relative Drawdown measures the largest percentage drop of the price process on a given time interval. Recently, Maximum Relative Drawdown has become more popular as an alternative measure of risk [1]. | (ABS(`Metric`.`Drawdown`.`TotalMax` - `Metric`.`Drawdown`.`TotalMin`) / ABS(`Metric`.`Drawdown`.`TotalMin`)) |

| OpenDrawdown | Drawdown while having an open position. | `Position`.`MaxAgainstTicksDuringPosition` * `Instrument`.`TickCost` |

Ratios

| Metric name | Details | Formula |

|---|---|---|

| RecoveryFactor [GLOBAL] | Recovery Factor is equal to the absolute value of Net Profit divided by Max Drawdown. Recovery Factor should typically be larger than 1. A Recovery Factor that is greater than that of Buy & Hold can indicate a strategy's ability to overcome a drawdown [1] | `Metric`.`PnL`.`Total` / ABS(`Metric`.`Drawdown`.`TotalMax`) |

| RiskFactor | Percentage of your max open drawdown value. | `Metric`.`OpenDrawdown`.`TotalMax` / `TradingSession`.`MaxDailyDrawdown` |

| RewardRiskRatio | Mean of loss positions divided by the mean of profitable positions. | `Metric`.`LossPnL`.`Average` / `Metric`.`ProfitPnL`.`Average` |

| NetStopRatio | Mean of profit related to your max daily drawdown. | `Metric`.`PnL`.`Average` / `TradingSession`.`MaxDailyDrawdown` |

Emotions

| Metric name | Details | Formula |

|---|---|---|

| FeelingLevel | Based on your feeling ratings that you set on each position. 0 reactive - 5 neutral - 10 euphoric. | `Position`.`FeelingLevel` |

| TrustLevel | Based on your trust rating that you set on each position. 1 low - 5 high. | `Position`.`TrustLevel` |

Timming

| Metric name | Details | Formula |

|---|---|---|

| TimeInMarketPerPositionSeconds | Time of your positions. | `Position`.`ElapsedTime` |

| TimeInMarketPerTradeSeconds | Time of your trades. | `Position`.`ClosedPartials[x].DurationMillis` |

| TimeBetweenPositionsSeconds | Time between open positions. | `NewPosition`.`Open` - `OldPosition`.`Close` |

Mastering the game

| Metric name | Details | Formula |

|---|---|---|

| FavorTicksDuringPosition | Counting from the trade that opens the position. | `Position`.`MaxFavorTicksDuringPosition` |

| AgainstTicksDuringPosition | Counting from the trade that opens the position. | `Position`.`MaxAgainstTicksDuringPosition` |

| FavorSecondsDuringPosition | Time with the position in positive PnL. | `Position`.`MaxFavorTimeSpanDuringPosition` |

| AgainstSecondsDuringPosition | Time with the position in negative PnL. | `Position`.`MaxAgainstTimeSpanDuringPosition` |

| FavorTicksAfterClosePosition | Ticks with the position in positive PnL after closing it. | `Position`.`MaxFavorTicksAfterClosePosition` |

| AgainstTicksAfterClosePosition | Ticks with the position in negative PnL after closing it. | `Position`.`MaxAgainstTicksAfterClosePosition` |

| FavorSecondsAfterClosePosition | Time with the position in positive PnL after closing it. | `Position`.`MaxFavorTimeSpanAfterClosePosition` |

| AgainstSecondsAfterClosePosition | Time with the position in negative PnL after closing it. | `Position`.`MaxAgainstTimeSpanAfterClosePosition` |

Trading plan / Other

| Metric name | Details | Formula |

|---|---|---|

| MaxInstantPnL [ABSOLUTE] | Max instant PnL of the session. | `TradingSession`.`MaxInstantPnL` |

| MinInstantPnL [ABSOLUTE] | Min instant PnL of the session. | `TradingSession`.`MinInstantPnL` |

| DefinedMaxDailyDrawdown [ABSOLUTE] | Defined max daily drawdown. | `TradingSession`.`MaxDailyDrawdown` |

| WatchPeriodAfterCloseSeconds [ABSOLUTE] | Period to watch market price after a position is closed. | `TradingSession`.`WatchPeriodAfterClose` |

Trading session replay and inspection

Learning from our errors is another key for success. We're offering a different ways to replay trading sessions to our customers, so you can replay your sessions and other's people sessions to learn and dive deep.

We'll offer a dedicated indicator to load adhoc session from you or a colleague, so you will be able to use your trading platform to do the analysis in the way you want.

Using the Session replay in the APP, you'll be able to replay your session as well, like it was recorded in video! Only volume and delta indicator values will be provided. If you need more flexibility, use the custom indicator for that! 😊️ PLANNED

Couching with professional traders ES

We're committed on giving you the best support. We think that a key to success is to be mentored by other professional traders that can guide you to the next level.

We set an agreement with a professional trader that can do sessions in Spanish. Contact us if you're interested. We will update this information when we can offer sessions in other languages.