Micro scalping toolchain

Execute fast moves with confidence.

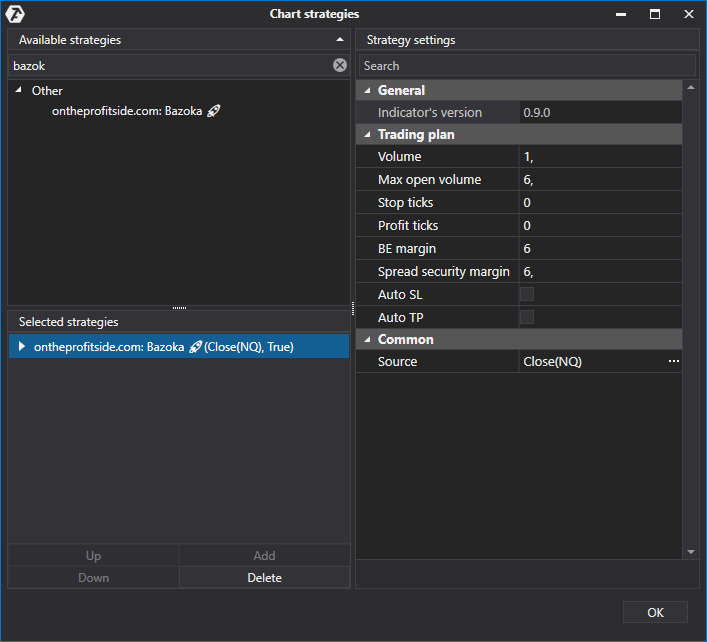

Bazoka 🚀

It's an indicator strategy that helps you execute fast movements while you trade.

Use it to increase or reduce the open position.

Set Break Even, Take Profit and Stop Loss with one key based on your defined parameters or automatically based on the current volatility in the market.

Change the contracts volume for the next operation with one key, so you can easily open a position with many contracts, change it to a lower level and reduce your position as you will.

More actions are coming! 🥳

How to use it?

Spread security margin: Number of ticks which will prevent you from setting a STOP or LIMIT order due to the spread existing between best ASK and best BID. Reduce it if you're trading in low volume scenarios.

Auto SL: When a new position is opened, it will set a STOP LOSS order automatically. Like pressing the D key.

Auto TP: When a new position is opened, it will set a TAKE PROFIT order automatically. Like pressing the E key.

Once you add the strategy to the chart you want to execute orders, you can now use your keyboard to trigger the actions. Here's the detailed list of actions:

| Key | Action |

|---|---|

| Q | Start the strategy |

| A | Stop the strategy |

| W | Open a BUY MARKET order with the volume configured (can be changed with a key). |

| S | Open a SELL MARKET order with the volume configured (can be changed with a key). |

| B | Set BREAK EVEN to the current open position. If you change the ongoing's position volume you can press again to set the new STOP order with the updated volume. NOTE: You can configure the number of ticks to set the STOP order. |

| D | Set a STOP LOSS for the current open position. If you change the ongoing position volume, you can press again to set the new STOP order with the updated volume. [*] |

| E | Set a TAKE PROFIT for the current open position. If you change the ongoing position volume, you can press again to set the new LIMIT order with the updated volume. [*] |

| R | Open a STOP order with the volume configured (can be changed with a key). |

| F | Open a LIMIT order with the volume configured (can be changed with a key). |

| 1-9 | Set the number as the volume to open when you open a new order. |

| 0 | Set the number as 10, the volume to open when you open a new order. |

[*] NOTE: You can configure the number of ticks to set the STOP/LIMIT order. If you set it to 0 it will set at the current volatility ticks (based on ATR indicator). You can set these values in the Stop ticks and Profit ticks params.